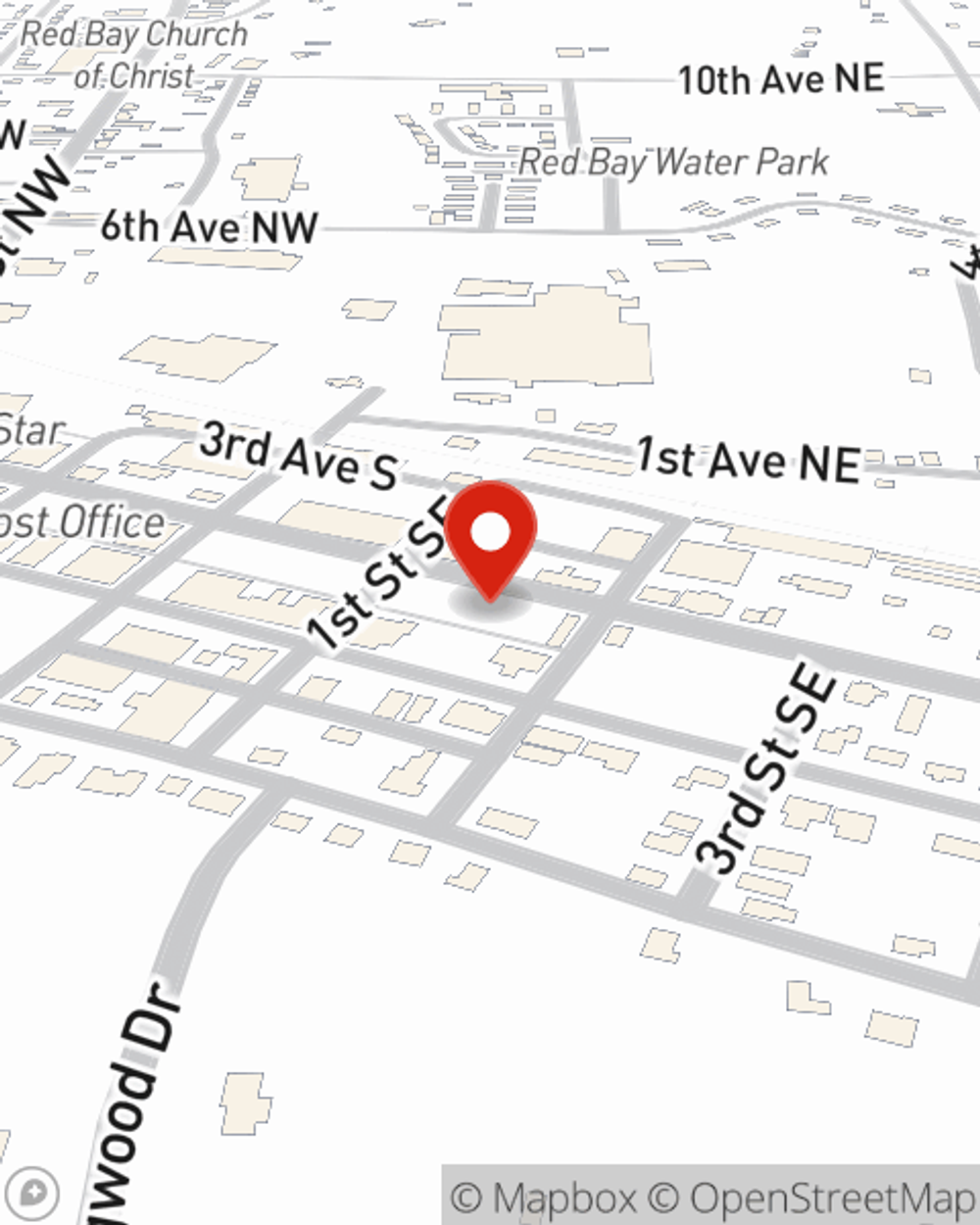

Business Insurance in and around Red Bay

Looking for small business insurance coverage?

This small business insurance is not risky

Help Prepare Your Business For The Unexpected.

When you're a business owner, there's so much to take into account. You're not alone. State Farm agent Ronald Thorn is a business owner, too. Let Ronald Thorn help you make sure that your business is properly covered. You won't regret it!

Looking for small business insurance coverage?

This small business insurance is not risky

Strictly Business With State Farm

Whether you are a barber an optician, or you own a donut shop, State Farm may cover you. After all, we've been into small business insurance since 1935! State Farm agent Ronald Thorn can help you discover coverage that's right for you and your business. Your business policy can cover things such as business property and business liability.

At State Farm agent Ronald Thorn's office, it's our business to help insure yours. Visit our terrific team to get started today!

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Ronald Thorn

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.