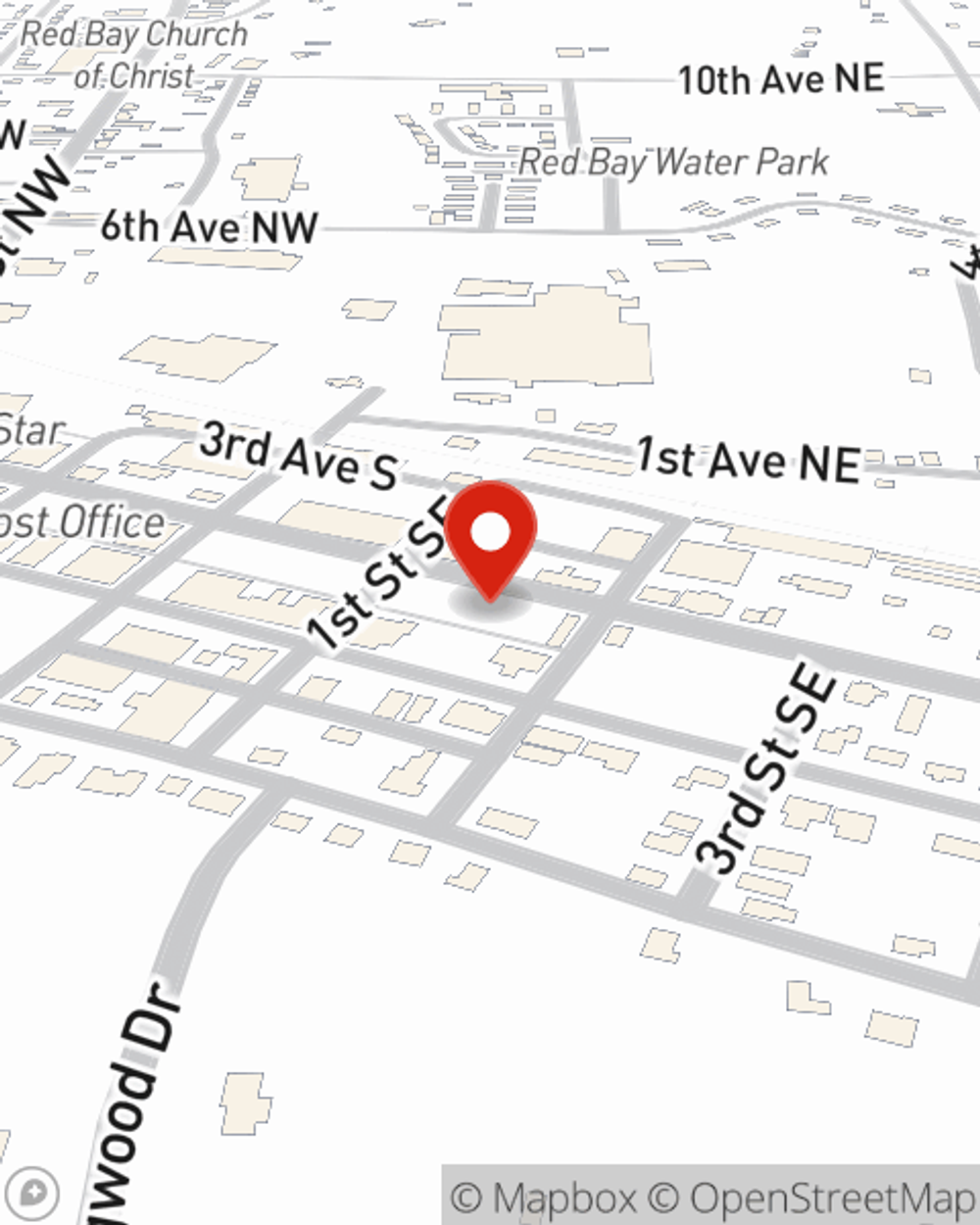

Life Insurance in and around Red Bay

State Farm can help insure you and your loved ones

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

State Farm Offers Life Insurance Options, Too

When you're young and newly married, you may think Life insurance isn't necessary when you're still young. But it's a good time to start talking about Life insurance to prepare for the unexpected.

State Farm can help insure you and your loved ones

Now is a good time to think about Life insurance

Life Insurance You Can Trust

Life can be just as uncertain when you're young as when you get older. That's why there's no time like the present to get Life insurance and why State Farm offers a couple of different coverage options. Whether you're looking for level or flexible payments with coverage to last a lifetime or coverage for a specific number of years, State Farm can help you choose the right policy for you.

If you're a person, life insurance is for you. Agent Ronald Thorn would love to help you discover the variety of coverage options that State Farm offers and help you get a policy that works for you and your children. Call or email Ronald Thorn's office to get started.

Have More Questions About Life Insurance?

Call Ronald at (256) 356-2700 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Ronald Thorn

State Farm® Insurance AgentSimple Insights®

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.